At a leadership conference last year, I heard the term “on-demand generation” used to describe American consumers today. Regardless of whether they are a boomer, Gen Xer or millennial, members of this “generation” are not bound by birth dates, but by the way people today consume products and services. We are a generation powered by on-demand media like Netflix, on-demand food delivery like DoorDash and on-demand transportation like Lyft. As a consumer, you can now marathon-watch entire seasons of your favorite TV show, order dinner without leaving the couch and then track where your food is — as it’s being made and picked up and then street by street as it’s getting to your front door. You can request a ride home with a click of a button and know that the driver is two minutes out so you don’t have to step outside in the cold until the car turns the corner.

This on-demand generation also happens to be extremely risk-averse. At our fingertips, millions of firsthand testimonials exist on Yelp, TripAdvisor and Amazon to take the risk out of our purchasing decisions. Before we even set foot in a restaurant or hotel, we know what’s on the menu and which rooms have the best view. There are even free browser extensions you can now install on Google Chrome and Firefox to compare Amazon products. Specs and ratings are listed side by side, including a YouTube video review and the same item’s price on eBay.

Over the past decade or so, this way of living has become so deep-seated in our everyday lives that it’s impacting not only how we consume products and services but also how we approach investing our money. Today’s “risk-averse, on-demand” generation of investors wants control, convenience and capital preservation.

Up-Down, Up-Down

Stock market investors have been on a roller coaster ride. After seeing substantial gains in 2017, the FTSE All-World index, which tracks more than 3,000 stocks in 49 countries across different market sectors, plunged 12% in 2018. At home in the United States, this stock market volatility manifested as a $3.73 trillion tumble in household net-worth in Q4 2018, giving investors PTSD flashbacks of the 2008 global financial crisis. While markets seem to have rallied in 2019, many are left speculating when the ax will drop next, especially as tariff threats hover over recent U.S.-China trade negotiations. This “up-down, up-down” instability has Americans, on average, holding 58% of their assets in cash. But there is a solution for investors seeking more stable investment opportunities and more control: real estate.

Controlling Risk With Real Estate

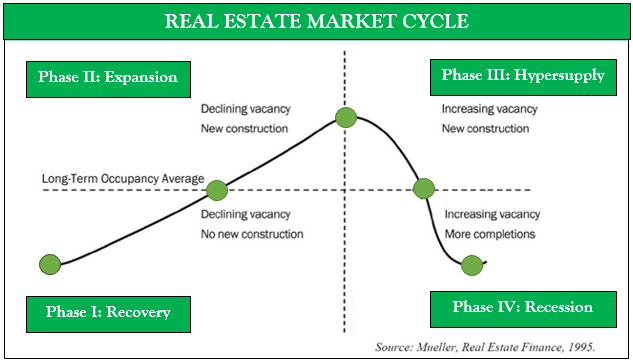

Companies can go bankrupt and stocks can fall to zero, but there will always be inherent value in land and in tangible assets. Real estate is uncorrelated to stocks and bonds, providing opportunity to invest large sums in a very short period of time without singularly moving the market and raising prices. Strategic diversification protects your capital investment, and if you’re able to correctly identify the phase each market is currently in, good investments can be found, whether the market is in a recession or expansion period, by adapting your investment criteria and exit strategy. You can effectively control risk by doing homework on the local real estate market dynamics and assessing economic trends, future developments and demand generators.

Increasingly popular among the on-demand generation is the income enhancement strategy. This strategy is useful to investors seeking stable, long-term cash flows and high risk-adjusted returns in a real estate portfolio. By selecting leasing and property management talent or retaining a private real estate investment firm with a superior talent network and history of exceptional tenant relations, investors reap the rewards that accompany an optimized asset management strategy without the headaches of having to manage the properties themselves. Typically, an experienced real estate investment firm implementing this strategy will utilize a rolling approach to stabilize cash flows and minimize business cycle risks. Aging properties are slowly refreshed with new ones — capital improvements are made, vacancies are reduced, rents are raised while being cognizant of managing tenant turnover and economies of scale are achieved — yielding stable annual returns.

There is no such thing as a 100% guarantee when it comes to investments, but there is a next best thing — options like real estate — where there’s intrinsic value in the assets. This allows investors to minimize risk by being extremely selective and adapting their strategy to market demands and economic trends, and there’s the ability to exercise control over how assets are managed. Whether you are chasing dividend yield, looking for low-volatility growth or seeking safe haven from market fluctuations, allocating a slice of your investment portfolio to well-managed, quality real estate is a powerful tool for investors to build wealth, generate consistent cash flow and hedge against inflation and vulnerability in the stock market.