*Our article has also been published at Forbes.com: Link

With most things in life, the best advice someone can give is to take a step back and look at the bigger picture. But when you’re evaluating real estate markets for investment, I’ve found that you have to get into the nitty gritty details.

By extrapolating assumptions from your local market to another, for example, you’re at risk of oversimplifying the playing field and overlooking potential deals that can either generate substantial cash flow or long-term appreciation. Think about it like the weather. Just because it’s a balmy day in Los Angeles doesn’t mean that there can’t be snow in New York at the same time. And even more granularly, there are submarkets within markets -- just like how - in California - it can be 100 degrees in Concord when only 25 miles away, it’s 54 degrees in San Francisco.

Knowing real estate markets intimately and being able to correctly identify the phase each market is currently in, is the key to recognizing what is a good investment vs. what to pass on.

The Basics

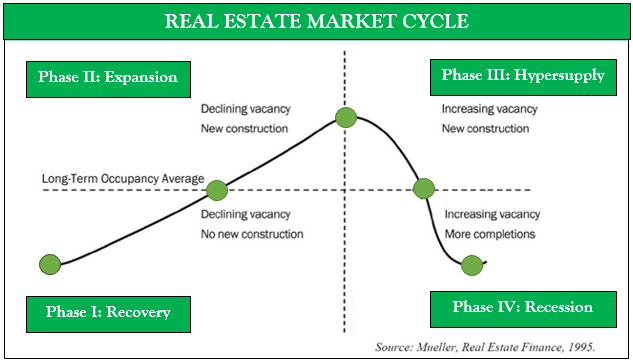

There are 4 phases in the cycle of real estate, and they look like this:

Phase I: Recovery

Recovery is typically the most difficult phase to identify – when a real estate market is recovering from a recession, demand can still be slow. Rental growth can seem flat and new builds are few and far between, so a lot of the time, the market can still look like it is in a slump. However, to those closely monitoring the data, upward trends in property viewings, the reduced pace of previous decline, or a break in the downward trend, are all signs that the market is coming out of the downturn.

During recovery, value-add properties with some need for renovation require careful evaluation but can present an opportunity to acquire, improve, and then resell the asset for strong returns during the upcoming expansion phase. This would also be the time to snap up core assets in a prime location and then ride the market up to expansion.

Phase II: Expansion

Markets in expansion are transitioning up and are faced with growing demand. The economy and job growth in these markets will look strong; rents are on the rise and vacancy is low. New construction jobs are plentiful, and at the height of this phase, supply and demand reach equilibrium. During this phase, developers can capitalize on higher demand and investors not keen on shouldering too much risk can pursue core plus strategies knowing that turnover is likely to be lower and rents are rising.

This is also a prime time to deploy value-add tactics. Investors and funds who know what they are looking for can secure neglected properties that require TLC or are mismanaged, at a discounted price, then bring these assets into full productivity before reselling for considerable profit.

Phase III: Hypersupply

Hypersupply occurs when an economy shifts into decline or new developments continue in parallel with falling demand. Both cause occupancy rates to fall and rental growth to slow. During this phase, savvy investors look for solid assets with stable tenants and long-term leases already in place. Even though no one can predict when the next expansion phase will come about, these fixed-term assets ensure a level of high performance until the next lease roll, providing stability when recession hits. Similarly, investors who can keep an even keel can take advantage of prime real estate divestitures from panicking sellers.

Phase IV: Recession

When the players in a market either don’t recognize the downturn, or choose to disregard the warning signs of waning demand, the hypersupply phase falls into the recession phase. Recession is distinguishable by its heavy supply, high vacancy rates, and reductions in rent. In this highly saturated market, investors willing to take on higher risk can acquire distressed bank-owned properties, vacant land developments, tear-downs, and construction projects at bargain prices compared to replacement cost. This is a long-term play for the patient investor willing to work to stabilize the asset and hold until the cycle moves back through the recovery phase. Investors must be very choosy, or risk getting cut as they catch a falling knife.

Final Takeaway

What’s important to remember is that different markets can be in different phases simultaneously. So a strategy that works in the Hypersupply phase in San Francisco will be less effective in an Expansion phase in Dallas.

Additionally, no one can predict how long each phase will last. Even if we take into account historical data, we can’t count on the same highs and the same lows, because the economy and is an ever-evolving playing field. Furthermore, since cycles can vary depending on geography and property type, the key is to be vigilant and to understand the nuances of each market and the best strategy to implement in each given situation. In doing so, you can build a diversified real estate investment portfolio robust enough to weather any storm.

Warm Regards,

Kimberly Yeh

Managing Director - Real Estate Acquisitions

About BENA Capital

BENA Capital manages real estate investment funds, with a central focus on the acquisition and management of residential multifamily assets in growing markets. BENA Capital's funds provide investors with ease of entry, reliable quarterly cash flow, and portfolio diversification. Our proven strategies emphasize sound investing in carefully researched, quality properties that have steady, long-term capital appreciation potential.

Click for Investor Overview PDF: BENA Capital Overview